Avoid these 6 common investment mistakes

When it comes to investment, knowledge is power. Avoiding the six common investment mistakes below will help you reach your investment objectives.

Published on 12 November 2025

·

3 min read

You have decided to invest - that’s great. It shows you are serious about building your future, growing your wealth, and making your money work as hard as you do. But even the most committed investors can stumble if they don’t know some key basics.

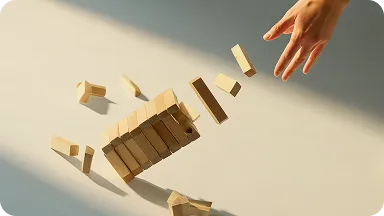

Mistake 1. Risking it all with one type of asset

Mistake 2. Investing in the unknown

Mistake 3. Trying to time the market

That means it is best to start early – even with small amounts - and use tools like Systematic Investment Plans (SIPs) to invest regularly. The perfect time to get started is always now.

Mistake 4. Making impulsive decisions

Mistake 5. Overlooking investment costs

Mistake 6. Assuming free is best

Bottom line: Learn before you leap

Successful investing isn’t about luck, guesswork or perfect timing; it’s about clarity, discipline, and making informed choices.

Take control today: your future self will thank you.

Disclaimer: This article is for educational purposes only.